Free consultation hotline

Free consultation hotline

International brand

Corporate image

Enterprise benefit

Register fast

Convenient account opening

Low cost

Tax declaration freedom

Tax avoidance

High confidentiality

Financial opacity

Offshore management

Simple, not complicated

Wide e-commerce platform

Ebay、Amazon

ASI、SAGE

Name relatively free;Annual review of California;There is an annual $800 state tax; it must be declared.

Strict name requirements;Annual review for two years;There are 25 Golden State taxes every year, which must be declared.

Very free;Low price and simple management;No fixed state tax;

Annual review;No fixed state tax;Exemption from state income tax。

Cannot end with Ltd / limited;Annual review before 5.1 every year;No fixed state tax.

Relative freedom;C 3.1 and LLC 6.1;Agency system; sales tax exemption.

Annual review before 5.15;Exemption from state income tax;

Need to check in;Exemption from state income tax;las vegas。

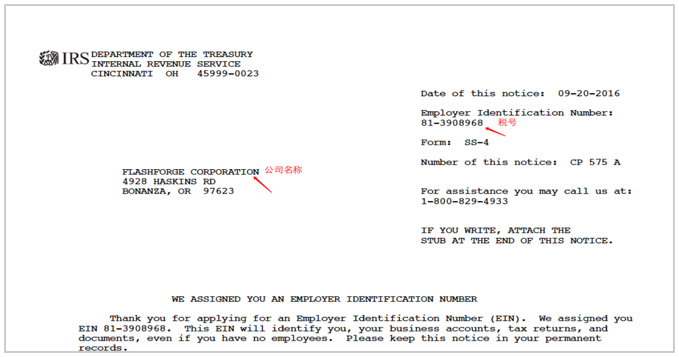

After registering a U.S. company, you need to apply for the U.S. federal tax number (EIN), also known as the employer identification number, which is unique. It is the number that the U.S. company actually operates and must apply for when filing tax. If you open an account in the U.S., you must also provide the federal tax number

Huamei Bank (accounts can be opened in 50 states): Huamei bank is headquartered in California; Huamei bank is a U.S. listed company with stock code ewbc in NASDAQ Global Select market. Huamei bank is the largest commercial bank in the United States with Chinese as its main market;

Cathay Pacific Bank, founded in 1962, is the first Chinese bank in Southern California. Its purpose is to provide financial services for the neglected but growing Chinese and Asian communities in Los Angeles.

At present, Cathay Pacific Bank has branches in California, Washington state, Nevada, Texas, Illinois, New York, New Jersey, Maryland and Massachusetts.

Certificate of incorporation; information form (California); federal tax number; articles of incorporation;

Applicant's passport and ID card, scanning copy; business license, address and zip code of China company;

The applicant's telephone number, email address, contact address and the name of the applicant's mother;

Business scope and annual income of the company, fill in the form (bank form);

Place of signature (Beijing, Shanghai, Shenzhen, Guangzhou, Chongqing, Xiamen, Hong Kong, Taiwan);

American company registration certificate; federal tax number; signed articles of Association; both sides of applicant's passport and ID card, scanning copy;

Applicant's telephone number, email address, contact address, name of applicant's mother, bank card and driver's license scanning copy;

Business license, address and zip code of China company;

Business scope and annual income of the company, fill in the form (bank form);

Place of signature (Beijing, Shanghai, Hong Kong, Taiwan);

After registration, regular annual review is required, or there will be a fine

Most of the annual reviews, some fixed time annual reviews, such as before Delaware 3.1, Georgia 4.1, Florida 5.1, Texas 5.15, etc.

Divided into state income tax and federal income tax;

Sales Tax: sales license required

The deadline for tax declaration is 12.31;

the deadline for tax declaration is the end of the previous month of registration.

Company name (in words)

IDcard and passport

English signature

California needs to provide

Submission, preliminary review

Query information

Distribution materials

Information to customers

Certificate

Duty paragraph

Information sheet

Constitution

Record

Roster

Prove

Seal, steel seal

Secretary card